Short Strangle Options Trading Strategy | Step-by-Step Execution Process, Payoff Graph, Pros & Cons, Adjustments

Introduction: Strangle vs. Straddle Options Strategies

In stock markets, both strangles and straddles are options strategies used to profit from significant price movements in the underlying asset.

- A straddle involves buying or selling both a call option and a put option with the same strike price and expiration date.

- A strangle involves buying or selling a call option and a put option with different strike prices but the same expiration date.

Short Strangle Options Trading Strategy

A “short strangle” is an options trading strategy in which an investor sells a call option with a strike price above the current price of the underlying asset, and a put option with a strike price below the current price of the underlying asset, simultaneously.

It is a type of neutral options strategy that is typically used in stable market conditions when the underlying asset is expected to remain within a certain price range. The strategy is designed to generate profits from the premiums received from selling the call and put options while limiting potential losses if the underlying asset price moves within the expected range.

- Example: Let’s say that a stock is currently trading at $100 per share. An investor could sell a call option with a strike price of $110 and a put option with a strike price of $90.

Step-by-Step Process of Executing Short Strangle Options Strategy

The step-by-step process for executing a short strangle options strategy is as follows:

- Identify an underlying asset that is expected to remain within a certain price range until the expiration date of the options.

- Select call and put options with strike prices outside the expected price range of the underlying asset.

- Sell the call and put options simultaneously.

- Receive the premium paid by the buyer of the options.

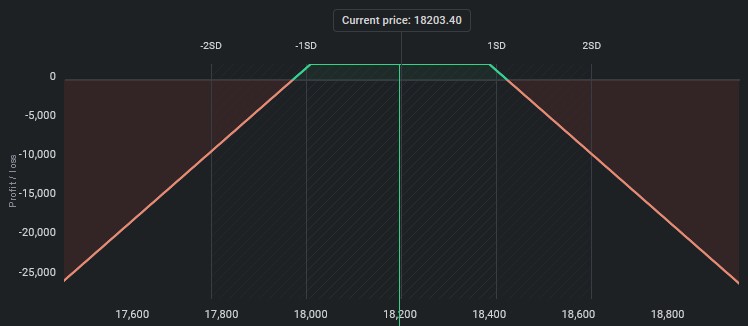

Payoff Graph for Short Strangle Options Trading Strategy

The payoff graph for a short strangle options strategy resembles a “V” shape, with the maximum profit being achieved when the stock price remains within the range of the strike prices of the call and put options sold, and the maximum loss occurring when the stock price moves significantly beyond these strike prices.

Pros and Cons of Short Strangle Options Strategy

Pros:

- Potential for profits in a stable market environment

- Lower cost of entry than a straddle options strategy

Cons:

- Potential for significant losses if the underlying asset price moves outside of the expected range

- Requirement for a significant amount of margin or collateral to enter the trade.

Adjustments to Short Strangle Options Strategy

If the short strangle options strategy is in profit, adjustments can be made by:

- Buying back one or both of the options sold, or

- Rolling the options to new strike prices or expiration dates.

If the strategy is in a loss, adjustments can be made by:

- Buying back one or both of the options sold, or

- Rolling the options to new strike prices or expiration dates while taking a loss.

Conclusion

In conclusion, the short strangle options strategy can be a profitable approach in a stable market environment, but it carries significant risks and requires careful consideration and management of risk. Traders should be aware of the potential for losses, and should have a clear plan for adjusting the strategy if the underlying asset price moves beyond the expected range.