Nifty Outlook | Support & Resistance: Technical & OI Data Analysis on 8th Jan, 2021 (EOD)

In my previous article, based on the data and chart, I mentioned that I was bearish on Nifty for this week. However, Nifty has done the opposite and has started the expiry week with a bang on the upside.

Since, Nifty did not go below the 14k mark, there would be no trade on the downside anyway.

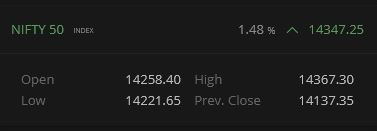

Nifty OHLC on 8 Jan 2021

The opening itself was comfortably above 14200 at 14258.40, marking it’s new all the high for the 10th trading session in a row. Nifty opened with 121.05 points gap up from it’s previous day’s closing price of 14137.35.

Unlike yesterday, Nifty did not go below 14200 which soon triggered a short covering rally. Nifty made a day’s low of 14221.65 and continued it’s upward journey to set a new all time high of 14367.30. At EOD, Nifty closed strongly at 14347.25.

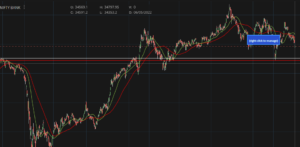

What does Nifty’s Chart tell us?

Nifty has finally given a comfortable breakout of the channel and the upside target of 14480-520 is on the cards. The immediate support will be the trend line and 14240-260 zone. Unless Nifty closes below this level, the bullishness may continue.

Nifty is already trading in an uncharted territory. The resistance at this level can be the next trend line that you see on the chart below, which comes around 14560 for Monday. We will also look at the OI data for supports and resistance.

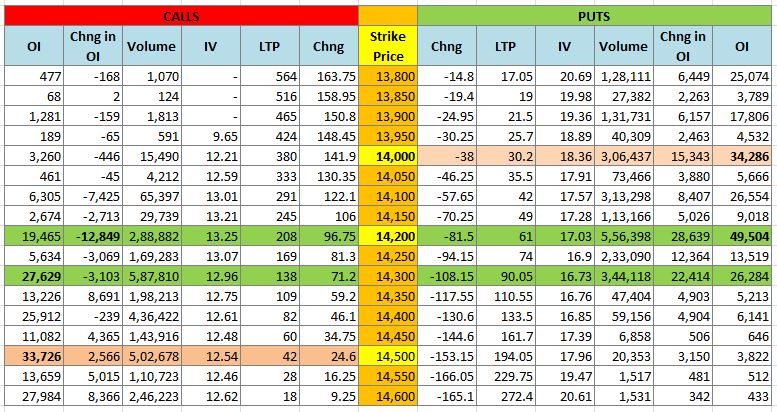

Nifty Open Interest (OI)

Calls: I could say it was short covering at the beginning of this article by looking at the open interest on the call side. The OI on 14200 strike has significantly reduced with an increase in the call premium.

The highest OI on the calls is at 14500 strike followed by 14300. As per OI 14500 will act as resistance.

Resistance levels: 14480-520, 14560 (Chart + OI)

Puts: The highest OI on the put side remains and in fact increased at 14200 strike. This indicates that put writing is aggressive at this strike price and will act as immediate support.

The second and third highest open interest are at 14000 and 14100 strikes respectively.

Support Levels: 14240-260, 14000, 13820-13780

Daily RSI increased from 73.56 to 77.38 indicating bullishness!

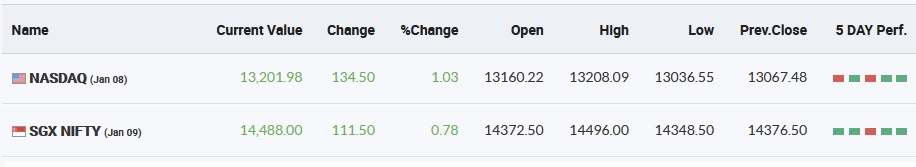

Global Cues and Other Factors

- NASDAQ has also closed strongly with a 1.03% gains

- SGX Nifty has already tested 14500 mark. It made a high of 14496 and closed strongly at 14488.

- Looks like things in USA also have settled

- Dow futures also closed in green

- There is a news that Indian Army has apprehended Chinese soldiers on the Indian side of LAC in Ladakh. Hope things will be stable and don’t turn out to be a dampener for the markets on Monday.

Follow us on:

Facebook: https://www.facebook.com/aimarrow/

Twitter: https://twitter.com/aim_arrow

Telegram: https://t.me/aimarrow

Instagram: https://www.instagram.com/aim_arrow/

Hashtags: #14Jan2021Expiry, #Nifty, #Nifty50, #NiftyBreakout, #NiftyChart, #NiftyFifty, #NiftyOI, #NiftyOpenInterest, #NiftyResistance, #NiftySupport, #NiftyTechnicalAnalysis, #NiftyView, #NiftyTA, #RSI, #Channel, #TrendLine, #MovingAverages, #niftoutlook #AimArrow

#stock #stockmarket #trading #money #investing #stocks #investment #trader #business #finance #invest #investor #daytrader #profit #trade #market #financialfreedom #wealth #dalalstreet #wallstreet #sharemarket #motivation #entrepreneur #stocktrading #stockmarketnews #sensex #success #nse