Open Interest (OI)

What is Open Interest (OI)?

Open Interest or OI refers to the number of derivative (futures and options) contracts of an asset that are currently open (outstanding).

For each buyer, there must be a seller, since you cannot buy something that is not available for sale. The buyer is said to be long on the contract and the seller is said to be short on the same contract.

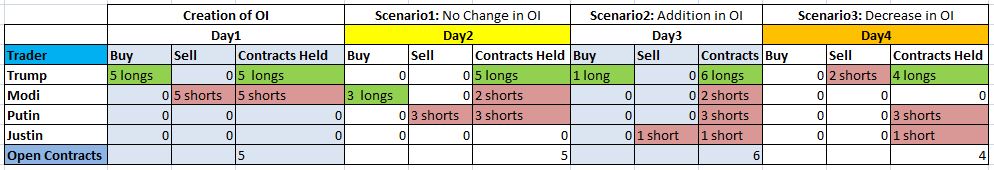

Day1: Let us say, Trump buys 5 Nifty Index contracts of May 2020 expiry from Modi, the open interest of Nifty in this case will be 5. Here Trump is long and Modi is short.

Day2 (OI Unchanged): Modi gets rid of 3 shorts by passing on the 3 short contracts to Putin. The OI remains unchanged at 5 as no new contracts were created. Modi passed on his existing shorts to Putin.

Day3 (OI Addition): Trump buys 1 contract from Justin. Open Interest will be increased by 1. Note that here 1 new contract has been created. Now the OI will be 6.

Day4 (Decrease in OI): Trump decides to get rid of 2 shorts and Modi decides to close his position. Effectively Modi transfers his 2 shorts that were leftover to Trump. Modi now has no open positions, while Trump has reduced his longs to 4 as two existing contracts were closed. Therefore the OI decreases from 6 on Day3, to 4 at the end of Day4.

The following image depicts the above scenarios:

Click on the image to view it in a new tab!

If you’ve noticed, if you subtract the total number of shorts from the total number of longs in the ‘Contracts Held‘ field, it always equates to zero. This is one of the primary reasons derivatives is often termed as a zero sum game!

Traders try to assess the trend of an asset using its open interest and change in price. Understand the scenarios by reading the following article:

http://aimarrow.com/derivatives/identifying-the-trend-using-price-and-open-interest/

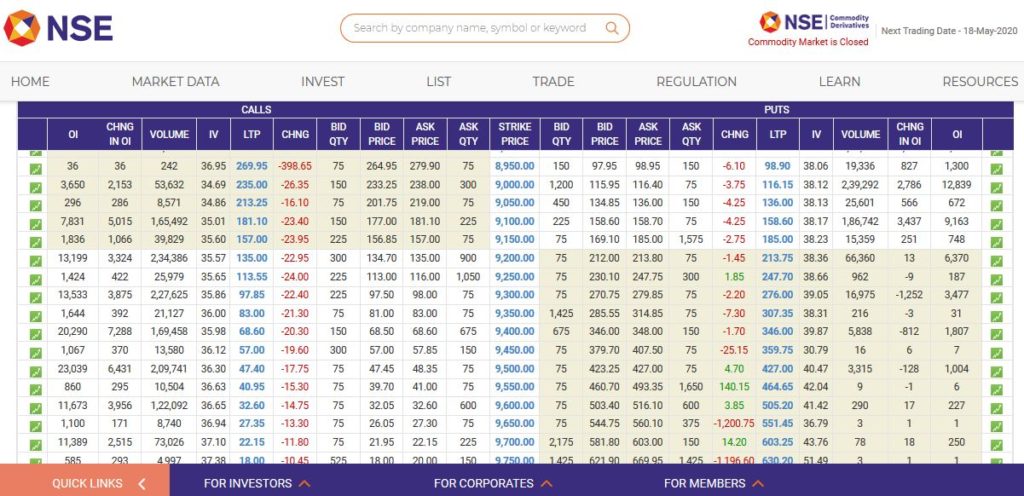

Where Can I Find Open Interest of an stock/asset?

In Indian markets you can find the open interest of an asset on NSE or BSE‘s websites.

On NSE: Home > Market Data > Market Watch > Derivatives Market > Select the Stock or Index that you want analyze > You will find OI of the selected here under the ‘Option Chain‘ tab.

Similarly on BSE, you can find OI data of an asset under

Home > ‘Market’ > ‘Derivatives’ > ‘Derivatives Chain‘

These days many stock broker terminals, apps and websites provide open interest data.