Call Ratio Back Spread Options Trading Strategy | Step-by-Step Execution Process, Payoff Graph, Pros & Cons, Adjustments

Introduction to Call Ratio Back Spread

Call Ratio Back Spread is a bullish options trading strategy that involves buying call options at a lower strike price and selling call options at a higher strike price with a greater number of contracts. This strategy provides unlimited profit potential while limiting the risk to the net premium paid for the options. In this article, we will explain the Call Ratio Back Spread options trading strategy in detail, including an example, step-by-step process of executing the strategy, pros and cons, payoff graph, and adjustments in profit and loss situations.

Example of Call Ratio Back Spread

Suppose ABC stock is currently trading at $100, and you expect it to increase in the near future. You can execute the Call Ratio Back Spread strategy by buying one ABC call option with a strike price of $95 and selling two ABC call options with a strike price of $105. Let’s assume the premium for the $95 call option is $5, and the premium for the $105 call option is $2. You will receive a net credit of $1 (i.e., $2 x 2 – $5 x 1) for executing this strategy.

Step-by-Step Process of Executing Call Ratio Back Spread

Here is a step-by-step process for executing the Call Ratio Back Spread strategy:

- Identify a stock that you believe will increase in price.

- Choose a lower strike price call option that is in the money and has a reasonable premium.

- Sell a greater number of call options at a higher strike price, which is out of the money and has a lower premium than the call option purchased.

- Receive a net credit for executing the strategy.

- Monitor the stock price movement and adjust the strategy accordingly.

Pros and Cons of Call Ratio Back Spread

Pros:

- Unlimited profit potential.

- Low-risk strategy.

- Generates income from the net premium received.

Cons:

- Requires precise timing to be profitable.

- Potential for significant losses if the stock price moves too far in the wrong direction.

- Limited profit potential if the stock price does not move significantly.

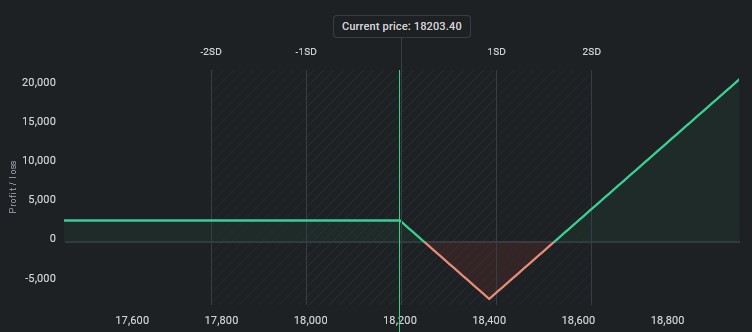

Payoff Graph for Call Ratio Back Spread

The payoff graph for the Call Ratio Back Spread options trading strategy is as follows:

The x-axis represents the price of the underlying asset, and the y-axis represents the profit/loss. The blue line represents the payoff at expiration, and the red line represents the payoff at the current time.

Adjustments to Call Ratio Back Spread in Profit and Loss Situations

In Profit Situation:

If the stock price increases and the Call Ratio Back Spread becomes profitable, you can adjust the strategy by closing out the short call option and letting the long call option run. This allows you to capture more profit potential while limiting the risk. Alternatively, you can also choose to close out the entire position and take profits.

In Loss Situation:

If the stock price decreases and the Call Ratio Back Spread becomes unprofitable, you can adjust the strategy by rolling down the short call option to a lower strike price or closing out the entire position and taking the loss. Rolling down the short call option reduces the risk of the strategy and allows you to stay in the trade while waiting for the stock price to recover.

Conclusion

The Call Ratio Back Spread is a low-risk, high-reward options trading strategy that is suitable for bullish market conditions. This strategy provides unlimited profit potential while limiting the risk to the net premium paid for the options. However, it requires precise timing to be profitable and can result in significant losses if the stock price moves too far in the wrong direction. As with any trading strategy, it is essential to understand the risks and rewards and adjust the strategy accordingly.