W. D. GANN’s Solar Dates

Gann’s Forecasting Methods

William Delbert Gann is considered as one of the most successful stock and commodity traders ever lived. W. D. Gann’s market forecasting methods are based on geometry, astronomy, astrology, and ancient mathematics.

Through his methods, he found that on certain dates the market trend changes. Gann says that on these days the Sun comes at 15 degrees or 90 degrees with earth. He considered these positions very significantly, and that the market sentiments tend to change on these dates. Sometimes Gann dates are exact and at times it is a day or two ahead or behind.

He used geometrical divisions of the solar year (solar degrees of longitude and calendar days) to ascertain turning points in financial markets. Days pertaining to 45, 90, 135, 180, 225, 270, and 315 solar degrees from Vernal Equinox (= 0 degrees Aries) are what he called Natural Trading Days.

Static and Dynamic Solar Dates

According to Gann, there are two types of Solar dates: Static and Dynamic. He always said the year begins on March 21st, which is the first static date and not January 1st. He also stated that this was a very important seasonal time.

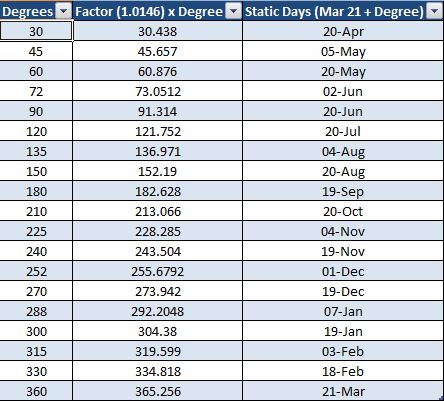

Here is how we get the static dates:

– Average days in a calendar year are 365.256

– Divide it by 360 (degrees in a circle) i.e 365.256 / 360 = 1.0146. Therefore, 1degree = 1.0146 days.

– Static degrees where a trend reversal or a significant impact on financial markets may occur as per Gann are 30, 45, 60, 72, 90, 120, 135, 150, 180, 210, 225, 240, 252, 270, 288, 300, 315, 330 and 360 degrees.

– Multiply these degrees with 1.0146 and add that to the first static date i.e. Mar 21 to get all the accurate static days.

Generally on these dates the market is expected to make major highs, lows, tops and bottoms.

Dynamic Dates:

The static dates starts with March 21st and calculated as mentioned above. But, to calculate the dynamic dates you need to consider a date where a top or bottom was formed and proceed accordingly.

How to these days?

You need to be alert on these days or a day or two before or after the static solar day and react to the market based on the price action or whatever setup you generally trade with. Other Gann techniques like Gann Swing, Square of 9 degrees etc may yield better results.